Hot news weekly from Gate.io

OCBC Bank of Singapore has partnered with a cryptocurrency exchange to provide green financing.

OCBC will make MVGX’s carbon credit tokens available to its clients. The tokens can be purchased by companies to offset their carbon footprint, while the proceeds from their sale will be invested in green projects such as reforestation and renewable energy.

OCBC and MVGX also intend to explore other avenues in environmentally-conscious financing. MVGX already issues carbon credit tokens, which are generated through the firm’s distributed ledger technology. They will also use blockchain technology to keep records of purchases and investments in green projects, and are set to launch later in the year. They plan to begin later this year and will utilize blockchain technology to keep track of purchases and investments in green initiatives.

The effort is primarily aimed at high-carbon industries like energy, shipping, and steelmaking, which are struggling to reduce their environmental effect. Instead, such businesses may buy green tokens to offset their carbon footprint.

Is this OCBC's first foray into crypto?

While the bank has previously indicated interest in blockchain technology, Monday's statement is one of its first official forays into the field.

OCBC announced intentions to create its own crypto exchange last year, citing rising crypto use in Singapore. However, it has yet to provide an update on its plans. However, it has yet to provide an update on its plans. However, early this year, it was reported that the bank was recruiting for crypto and blockchain experts. In the face of increasing competition from digital lenders, the bank has also laid out a three-year plan to expand its internet footprint. Singapore has some of the friendliest cryptocurrency rules, making it a popular destination for crypto companies.

The environmental effect of cryptocurrency

The issuing of green tokens is an example of crypto's ecologically beneficial uses. The high energy cost of mining is drawing increasing criticism from politicians and investors.

In the Crypto Push, Goldman Sachs Offers Its First Bitcoin-Backed Loan.

Goldman Sachs Group Inc. announced its first-ever Bitcoin-backed lending facility, marking a significant step forward for a major American bank and accelerating Wall Street's acceptance of cryptocurrencies.

According to a bank representative, the secured lending facility lent cash with the borrower's Bitcoin as collateral. The purchase piqued Goldman's interest because of its structure and round-the-clock risk management, she wrote in an email. After years of reluctance, Wall Street banks are boosting up their crypto services, thanks to a jump in price and popularity. Goldman, which began trading over-the-counter Bitcoin options in March and has a digital-assets division, has taken a move into a new business area that is now dominated by crypto businesses.

BlackRock Inc. joined a $400 million fundraising round in stablecoin startup Circle last month, while Jefferies Financial Group Inc. is extending banking services for crypto customers. Cowen Inc., a boutique investment bank, launched a digital assets subsidiary in March.

Wealth management, trading, and investment banking are just a few of the crypto-related goods and services presently available on Wall Street. The next phase is to lend to enterprises that supply virtual currency as security. Galaxy Digital Holdings co-president Damien Vanderwilt recently stated

The Company Aiming for "Data Democracy," Jasmy Inc., Hosted Its First Strategy Briefing Session.

On Friday, April 22, 2022, Jasmy Inc. (Minato-ku, Tokyo, President Kazumasa Sato) conducted its inaugural strategy briefing. Jasmy Inc. is a developer and supplier of a unique platform that integrates IoT and Web3 technologies with the objective of "Data Democracy." We aim to create a world where people can utilize information more safely and securely depending on their own preferences." In today's information society, the processing of personal information has a structure in which profits are gathered solely by a few firms owing to a centralized method, and numerous issues have been handled. "By popularizing our unique decentralized solutions leveraging Web3 technologies like blockchain and IoT, we are establishing a platform that addresses this problem and satisfies individuals, corporations, and communities." We aim to be at the forefront of the Web3 age."

The Ecosystem of Jasmy:

"Jasmy intends to create a platform that facilitates the transaction of massive amounts of IoT data through a method underpinned by the value of personal data," said Hiroshi Harada, CFO. "DD coin is a common currency with a yen-denominated stable coin (not cryptocurrency) function," according to the recently released "DD Coin." We aim to build it such that people can simply earn like points in return for sharing their own information." "The cryptocurrency 'JasmyCoin,' which is traded on exchanges all over the world, will be utilized as a utility for activating our wallet," says the company. We'd want to establish a method that can contribute to the actual economy as one of the few Japanese functioning firms that issues cryptocurrencies."

Takashi Hagiwara, Director and Supervisor of Software Development, also introduced Jasmy's services. "By merging our patented services Smart Guardian (SG) and Secure Knowledge Communicator (SKC) with industry standard compatible blockchain and NFT, Jasmy will deliver a unique platform." We'll also employ AI to handle and analyze personal data, as well as provide a range of services."

Jasmy Inc.

Jasmy Inc. is a firm that specializes in IoT platforms and solutions. The core human requirements of "clothing, food, housing, and transportation" will alter dramatically if items and services are connected to the internet. The objective of Jasmy is to create and supply a system (platform) that allows anybody to safely and securely use data. In recent years, a tiny handful of worldwide big platformers have monopolized the rich data provided by our daily lives. With the Jasmy Platform, we hope to build a world where each person's personal data is safeguarded, allowing them to utilize their data safely and securely. Jasmy has achieved this by combining Blockchain and IoT technologies in a unique way to deliver the best platform solution for clients all over the world and across sectors.

Members of the Jasmy team have broad and extensive backgrounds in electronics, mechanical, communication, device, system integration, and design. For our global clientele, we will supply the greatest IoT platform.

Fantom: Is it possible that FTM's rally will be fueled solely by development?

Users of blockchain technology are known to be lured to any blockchain that offers a cheaper and faster option to the others. This is what Fantom, a high-performance, scalable, EVM-compatible, and secure smart-contract platform, aims to deliver.

In this perspective, it's worth noting that the Fantom Foundation has announced several noteworthy advancements in recent weeks.

There are several 'doings.'

The Fantom Foundation recently published a blog post that summarized all of Fantom's recent noteworthy advancements. The foundation announced the release of version 2 of its fWallet, which allows users to handle Fantom ecosystem currencies among other things. A few protocols have been added to the foundation's blockchain, according to the blog post. However, it's critical to determine if these changes have had an impact on the price of FTM.

The FTM token has increased by almost 2% in the previous 24 hours. The price was $1.07 at the time of writing, down from a high of $1.38 just over a month earlier. The price of the token has dropped by 69 percent since its all-time high of $3.48 in October. The cryptocurrency is ranked #43 on the list of top cryptocurrencies, with a market value of $2.73 billion. The token's market cap has continuously fallen by 15% during the previous 14 days.

The trading volume for the token has increased somewhat during the previous 14 days. Notably, FTM's trading volume increased by 6% during this time.

Within the previous 14 days, there has been a lot of negative movement on the price charts. The 50-day exponential moving average (EMA) remained above price levels, indicating a negative bias.

On the 17th and 18th of April, the Money Flow Index (MFI) reached a severely oversold level of 4.15, confirming this. The MFI was slightly over the 20 region at the time of publication.

Getting a Glimpse of the On-Chain

In the previous 14 days, the token's transaction volume has decreased. From a high of 25.28b on April 11 to a low of 21.36m on April 25, the token has lost 16 percent of its value. Furthermore, when the Daily On-Chain Transaction Volume in Profit was taken into account, it exhibited tremendous increase, with a Daily On-Chain Transaction Volume in Profit of 4.85 million on April 25. This was an increase of more than 80% above the 2.6 million reported 14 days prior.

Similarly, the token's daily On-Chain Transaction Volume decreased by 15% in the same time period. Furthermore, with a market value of $2.73 billion, Fantom will need more than claims of being a faster and cheaper alternative to other blockchains to compete with Vitalik's Ethereum, which has a market capitalization of $361 billion.

THE MARKETCAP OF CARDANO KILLER BITGERT COULD EXCEED $1 BILLION.

Bitgert has shown that in a single bull run, it can increase its market capitalization by 300 percent. Bitgert (BRISE) has been tipped as the Cardano killer, and the project has so far delivered. The achievements of the Bitgert team thus far demonstrate a project that will not just exceed Cardano but also many other leading cryptocurrencies.

Will Bitgert's market capitalization reach a billion dollars? This is, after all, the question that most cryptocurrency investors are asking. Crypto experts believe that is quite likely. Let's take a look at some of the key aspects of the Bitgert that will allow it to achieve the $1 billion market value and dethrone Cardano.

Bitgert

First and foremost, Bitgert's market capitalization surpassed $700 million in early March 2022. This is after soaring from roughly $200 million MC in only a few weeks. As a result, Bitgert has demonstrated that it can increase its market capitalization by 300 percent in a single bull run. With the market valuation hovering around $500 million, Bitgert will be a breeze for Brise to achieve the $1 billion milestone.

However, the Bitgert team is achieving this by moving quickly to build the project and delivering some of the most revolutionary technologies to market. The debut of the Bitgert BRC20 blockchain fueled the most recent bull run, which hit $700 million MC. The adoption of the chain is continually increasing, and this is projected to be a big factor in Bitgert's marketcap growth.

The fast-growing number of Startup Studio is also projected to boost the Bitgert marketcap. The team intends to bring over 100 projects every month. By the end of the year, the chain will have roughly a thousand projects. The adoption of the BRISE currency will increase as more projects are published on Bitgert's DEX. This is what will propel Bitgert's market worth to $1 billion.

Bitgert is likely to overtake Cardano because to its robust blockchain and rapidly expanding ecosystem. The Bitgert chain is quicker than the Cardano chain and has a cheaper gas charge. Bitgert will undoubtedly defeat Cardano with a wider ecosystem.

Cardano

Cardano differentiates apart from other blockchains because it is based on scientific research. Hoskinson and his IOHK team have created a strong chain that has overcome the blockchain trilemma. However, the Cardano chain's overall performance on important components of the trilemma has proven a problem. Solana and Bitgert, for example, are outperforming Cardano in terms of speed and gas fee.

The IOHK, on the other hand, has been working on a variety of enhancements that might make Cardano the greatest chain in the market by 2022. Cardano's speed might be pushed to a million TPS by the Vasil hard fork, which is set to deploy in June. The Cardano chain will also do well in the industry because to the Hydra scaling technology.

DeFi protocols that focus on multi-chain, equities, and stablecoins are gaining traction.

Despite the current dip in the crypto market, Balancer, DeFiChain, and cBridge all experienced an increase in total value locked. Due to global economic challenges on several fronts, supply chain restrictions, scorching inflation, and the ongoing war in Ukraine, the cryptocurrency market has had an uphill struggle throughout the most of 2022.

Despite the general downturn in crypto assets, numerous decentralized finance (DeFi) protocols have been able to improve their foundations and attract new users to their ecosystems. Here are four protocols that are exhibiting signs of resilience even as the crypto industry as a whole struggles to find its feet.

Balancer

Balancer (BAL) is an Ethereum (ETH)-based automated market maker (AMM) that provides users with a variety of DeFi features such as the ability to stake tokens, provide liquidity, participate in governance votes, and execute token swaps.

Despite declining cryptocurrency prices, the total value locked (TVL) on Balancer is presently $3.54 billion, according to statistics from Token Terminal. This is the third-highest TVL in the protocol's history. The Balancer TVL's long-term viability is owed in part to an increase in assets committed in stablecoin pools on the platform, as well as a more involved governance structure that allows veBAL hodlers to vote on which pools get the majority of BAL reward emissions.

DeFiChain

DeFiChain (DFI) is a DeFi protocol that was forked from the Bitcoin code and works in tandem with the Bitcoin network to provide users with access to crypto assets and tokenized equities.

According to Defi Llama data, DeFiChain's TVL achieved a new all-time high of $901.16 million on April 5 and is now at $831 million following the latest price drop. DFI's price has stayed reasonably stable in comparison to the rest of the crypto market, now trading at $4.12 after reaching a high of $4.63 on April 3. DeFiChain's robustness is owed in part to the protocol's ongoing development and extension, which recently included support for tokenized equities for Walt Disney Company, iShares MSCI China ETF, MicroStrategy Incorporated, and Intel Corporation.

NEAR Protocol

The NEAR protocol (NEAR) is a layer-one blockchain network that aims to serve as a community-run cloud computing platform with fast transaction rates at a reasonable cost.

The price of NEAR hit an all-time high of $20.42 on Jan. 16, and the most recent rally saw the price rebound to $19.81 on April 7. 2022 has been a good year in general for the project, with the price of NEAR hitting an all-time high of $20.42 on Jan. 16 and the most recent rally seeing the price rebound to $19.81 on April 7. According to statistics from Defi Llama, the NEAR protocol has never had it so good in DeFi, with the total value locked on the network presently at a record-high of $363.72 million. NEAR's fundamentals are strengthening as a result of the successful conclusion of a $350 million fundraising round headed by New York-based hedge firm Tiger Global, as well as anticipation that the NEAR token might be listed on Coinbase shortly.

cBridge

Celer's cBrige, a multi-chain network that allows assets to be transferred across 26 distinct blockchain networks and layer-2 protocols, is also doing well. The cBridge protocol's TVL is continually increasing as the protocol's list of supported networks grows, with some of the most recent additions including Astar, Crab Smart Chain, Milkomeda Cardano, and Shiden.

The total value of all cryptocurrencies is currently $1.846 trillion, with Bitcoin commanding 40.9 percent of the market.

After the official launch of BitGert Chain, the BRISE token reaches new highs.

Despite the fact that crypto markets are down, the price of BRISE has increased by about 1,000%. This is why this new endeavor is causing such a stir. The cryptocurrency industry as a whole has taken a back seat to global events, but that hasn't stopped developers from creating.

Bitgert (BRISE), a crypto engineering organization that has set out to build a blockchain network capable of processing 100,000 transactions per second for little to no cost to the user, is one project that has recently begun to gain traction thanks to its focus on creating a high throughput, low-cost blockchain network. "The debut of the Bitgert Chain, the beta release of the Bitgert Exchange, and a series of new collaborations and exchange listings are three reasons for BRISE's surge in popularity."

The Bitgert Chain is now live.

The introduction of the Bitgert Chain on February 14 was the most important development in Bitgert in the last month. The BRISE token is now accessible on the Bitgert Chain's mainnet as well as the BNB Beacon Chain as a BEP20 token that can be bridged between the two networks, thanks to the Bitgert Chain's introduction. According to Bitgert, the Bitgert Chain follows the BRC20 standard and can process 100,000 transactions per second with a gas price of roughly $0.00000001 per transaction.

The Bitgert blockchain is built to accommodate a wide range of decentralized financial applications, nonfungible token projects, and Web3 protocols.

Bitgert Exchange is a cryptocurrency exchange.

The Bitgert Exchange beta version was introduced on March 6, which might be a bullish aspect for the project. The Bitgert Exchange is the Bitgert Chain's initial exchange protocol, and it currently supports trading for Bitcoin (BTC), Ether (ETH), Litecoin (LTC), Dash (DASH), and Dogecoin (DOGE) (DOGE).

Bitgert Exchange will be the first crypto exchange to provide consumers a zero-trading-fee environment, according to documents on the protocol's website.

Partnerships and listings on stock exchanges

A succession of protocol alliances and exchange listings have helped extend knowledge and access to the token, which has helped improve BRISE's price. BRISE has been listed on Gate.io, Coin98 Exchange, BitMart, Belon.io, Hoo.com, BitForex, and HotBit since the Bitgert Chain was launched in mid-February.

Bitgert also announced new collaborations with Sphynx Labs, Omniaverse, 4D Twin Maps, and Innovativ Plastics, as well as the establishment of the Bitgert Startup Studio program, which aims to assist entrepreneurs and companies acquire financing to launch their ideas or businesses as a BRC20 smart contract.

The Telos Blockchain has joined the Bloktopia Metaverse.

In Bloktopia, Telos, a reliable layer 1 backbone provider for Web 3.0 / Metaverse, takes on virtual space. Telos Blockchain (Tlos) has become a virtual tenant of Bloktopia and is already putting the space to good use. The Telos team will be able to utilize the area as a virtual conference room for all of its AMAs now that Bloktopia is set to start its Alpha (ask me anything - meetings). Telos has a lot to say about its newly released Ethereum Virtual Machine (tEVM), its decentralized file storage system (dStor), and its plans, and a metaverse environment seems like the ideal venue for these discussions. After all, both the tEVM and the dStor can and will be used to support Web 3.0 dApps.

"Bloktopia's metaverse is a significant step forward in Web 3.0 adoption, and the Telos team is excited to go in head first." This is only the start of a multibillion-dollar industry, and it's only the beginning of our enormous metaverse goals." (Justin Giudici).

Telos is a 3rd Generation layer 1 blockchain that has been continuously executing energy-efficient smart contracts since 2018. Every Telos Network transaction consumes less than 0.000002 kWh of energy and costs end customers $0 to near-zero in gas expenses. Telos is quicker than any other chain in generating blocks and smart contracts for Solidity, Native C++, and Vyper. The network's main strength is its heavy reliance on C++ and a unique Wasm runtime environment. It's extremely efficient, and it's one of the key reasons why Telos allows Web 3.0 dApps to perform immediate transactions.

Before any future sharding / rollups, Telos is currently capable of serving hundreds of millions of nearly fee-free transactions each day. This degree of capability will be required for the Metaverse to thrive. Telos' present capacity is adequate to fulfill the transaction demands of every existing layer 1 chain, as well as all of their projected future development over the next decade.

With any of the third-party comparisons below, one can plainly observe some of Telos' demonstrated qualities for themselves.

Three reasons why the price of Telos (TLOS) has reached a new all-time high

TLOS has risen 229 percent from its January low, thanks to new alliances and the introduction of various NFT and DeFi apps. Traders who are aiming to put up long positions where solid fundamentals overcome the absence of short-term returns are typically rewarded by projects that continue to move forward by focusing on development and expansion during times like these.

Telos (TLOS), a blockchain network established using the EOSIO software that seeks to offer speed and scalability to smart contracts for decentralized finance (DeFi), nonfungible tokens (NFTs), gaming, and social media, has withstood the storm in the crypto markets to set a new all-time high.

Several new collaborations that expanded awareness of the project, the introduction of nonfungible token and decentralized finance initiatives on the TLOS network, and the token's integration with the Anchor wallet are three reasons for the rising price and momentum for TLOS.

Collaborations help to raise brand recognition.

In recent weeks, the Telos network has seen numerous new collaborations and integrations that have served to raise public knowledge of the protocol. DappRadar, which allows followers keep track on decentralized apps (DApps) on the Telos network, was one of the most prominent integrations.

The Telos Foundation recently announced a partnership with BikeChain, a self-governing ride-sharing service that would use the Telos blockchain to execute all of its transactions.

DeFi and NFT DApps are now available.

The development of many new NFT and DeFi apps on the Telos network, which are helping to drive liquidity and users to the protocol, is a second reason attracting attention to the protocol.

OmniDEX, the first native decentralized exchange built on the Telos network, was just released on the network. The TelosPunks NFT project, the cross-chain NFT marketplace tofuNFT, the NFT social media tool APPICS, and the AristotleDAO DeFi protocol are among the new Telos initiatives.

Learn about the Kyber Network Liquidity Protocol's KNC Coin.

The Kyber network is a decentralized liquidity protocol that combines liquidity from different sources to deliver secure and quick transactions (DApps). The Kyber Network's major purpose is to make it simple for DeFi DApps, decentralized exchanges (DEXs), and other users to access a liquidity pool with the best pricing.

On Kyber, all transactions are on-chain, which means they can be validated with any Ethereum block explorer. Kyber may be used to build projects that take use of all of the protocol's features, such as fast token settlement, liquidity aggregation, and flexible business models.

What exactly is KNC Coin?

The Kyber Network Crystal (KNC) token, also known as KNC Coin, is a utility token that unites the Kyber ecosystem's diverse interests.

KNC holders can use their tokens to help build up the platform and vote on crucial proposals on KyberDAO with their KNC tokens. Aside from that, they receive Ethereum (ETH) incentives from trading commissions. The Kyber Network has a total quantity of 210 million KNC tokens as of May 2021. Only about 200 million tokens are now in circulation.

KyberDAO can choose to raise or reduce supply of the KNC token in order to stimulate innovation, kickstart liquidity, and reward early adopters of innovative protocols. On September 15, 2017, Kyber concluded its initial coin offering (ICO), raising USD 52 million (about IDR 747.2 billion) by selling each KNC token for 0.00166 Ethereum.

According to the official token distribution statistics, during the ICO, 61.06 percent of tokens were sold, 19.47 percent were held for founders, advisers, and investors, and the remaining 19.47 percent were allocated for corporations. Kyber is an ERC-20 token that is created on the Ethereum network and safeguarded by it. Furthermore, Kyber has a comprehensive trust and security architecture that protects users from malicious administrators or exchanges using protocol and smart contract security features.

KNC's founder

The Kyber Network project began in 2017 and is based on the Ethereum blockchain. Loi Luu, Victor Tran, and Yaron Velner created the project, which now has its headquarters in Singapore.

Loi Luu is a blockchain researcher who also serves as a consultant to a number of blockchain initiatives. He co-founded SmartPool, the first open source security analysis for Ethereum smart contracts, and created Oyente, the first open source security analyzer for Ethereum smart contracts.

Victor Tran is a Linux system administrator and senior backend engineer. Yaron Velner is a postdoctoral researcher and the current CEO of B.Protocol, a decentralized backup liquidity protocol. A number of executive advisers, engineers, and designers make up the Kyber team. According to the Kyber Network's official LinkedIn profile, the firm employs more than 50 people, the majority of them are situated in Vietnam or Singapore.

Ava Labs raises $350 million to expand Avalanche, which is valued at $5.25 billion.

Ava Labs, the firm behind the Avalanche blockchain, is said to be in the midst of obtaining more funds. Ava Labs, the Avalanche blockchain's principal developer, is looking to raise $350 million in investment. According to a Bloomberg article citing people familiar with the situation, the latest round will value the New York-based business at $5.25 billion.

Those persons spoke on the condition of anonymity since the financing was not made public, with one source confirming the valuation. If verified, the fundraising will propel Ava Labs into the coveted unicorn club, making it a more valuable cryptocurrency company than Binance's US affiliate, which received $200 million at a valuation of $4.5 billion earlier this month.

According to Crunchbase, Ava Labs has raised a total of $290 million in investment over seven rounds. The company's most recent funding round occurred in September 2021, when Polychain Capital and Three Arrows Capital launched a private token sale that raised $230 million.

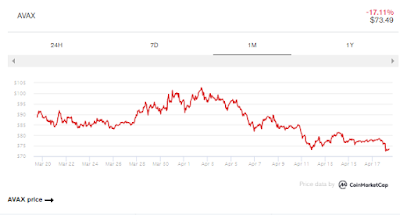

The AVAX token, which underpins the Avalanche blockchain, reacted warmly to the news, rising 5% to an intraday high of $81.74 earlier on Thursday.

Despite a little reversal since then, AVAX is still up roughly 4% on the day, trading at $79.59 at the time of writing, according to CoinMarketCap. However, it is still down over 5% for the week, owing to the overall crypto market downturn.

AVAX is the industry's tenth largest cryptocurrency by market capitalization, valued at nearly $21.4 billion.

Taking aim at the opposition

Emin Gün Sirer, a Cornell University professor, co-founded Ava Labs in 2018 with the goal of making Avalanche a blockchain of choice for decentralized app (dapp) developers, competing with Ethereum and Solana on speed and transaction costs.

Avalanche supports roughly 250 active apps, according to statistics from DappRadar, ranging from decentralized finance (DeFi) to games. According to DefiLlama, Avalanche is the fourth-largest blockchain in terms of total value locked (TVL), behind Ethereum, Terra, and the BNB Chain, with approximately $10.6 billion protected across the DeFi universe.

The network has witnessed several significant advances in recent weeks that might help it flourish. The Avalanche Foundation announced a $290 million fund last month to assist developers in expanding the number of subnets—validators that let others to create their own Layer 1 or Layer 2 blockchains.

The Fantom FTM Token is up 10% as a result of upcoming protocol upgrades.

After developer departures shook investor trust, the Fantom Foundation pledges greater network performance. Following the announcement of impending protocol improvements, FTM, the Fantom Network's principal token, has risen as much as 10% in the last 24 hours.

Fantom is a decentralized finance (DeFi) network that runs on a layer 1 (or base) blockchain technology. Fantom's foundation intends to strengthen its network by reducing memory use, increasing storage capacity, and adding new security measures.

In a blog post published on Wednesday, the Fantom Foundation stated, "This technology has the potential to help process transactions quicker with substantially lower memory consumption, hence boosting network performance." Furthermore, according to the foundation, while the Ethereum blockchain requires numerous block confirmations to maintain transaction security, Fantom simply requires one confirmation.

Price estimate for MovieBloc: Is there a way to break the monopoly?

Through the advent of streaming services like Netflix and Apple TV leading to a more centralized world of film and television distribution, some crypto firms are hoping to counteract the trend with blockchain technology.

MovieBloc was established in 2019 by the Korean streaming platform Pandora TV in an attempt to break the monopoly of streaming titans in the television and film industries. According to its website, the ecosystem is using the power of blockchain to return ownership to the creators.

While this project appears to be attracting a lot of interest from investors, MBL's 2022 has been a rollercoaster ride thus far. Let's take a short look at MovieBloc's native token, MBL, before we look at any estimates.

What is MovieBloc (MBL)?

MovieBloc began on the Ontology blockchain and has since been listed on a number of exchanges, including Binance and Upbit, allowing viewers and producers to receive incentives and contribute to the platform.

Creators can collect donations from viewers using the native token, MBL, which gives them more power and influence over their work than is typical. When uploading a film, the uploader has the option of deciding how much people should pay to see it. Advertisement is another way for creators to make money.

On the site, viewers may also earn MBL by giving community services like as reviews, subtitling, or marketing materials. If a viewer's subtitles are selected and played alongside the video, according to the website, The person will earn 5% of the creator's income share, and viewers who upgrade to the premium subscription will have access to a bigger selection of films.

The platform is available in 78 languages, with over 600 subtitles and over 300 feature and short films. "The world's largest participant-centric movie ecosystem," says the website.

MovieBloc acquired Cobak, a Korean crypto community service, in February 2020. "Cobak has the world's premier mobile service [which] includes crypto wallets, community, real-time ticker, news, airdrop and token sales services," according to MovieBloc's Medium release. MovieBloc's service operations would be reinforced as a result of the merger with Cobak, according to the company. Continuance Pictures, billed as "one of Australia's most intriguing rising film production businesses," will release its films through the MovieBloc platform as a result of the relationship.

Founders

Chris Kang, Jeffrey Jin, and Peter Kim co-founded MovieBloc. Kang, who is from South Korea, studied cinema and television at Boston University in the US. After that, he worked as an analyst in movie distribution at CJ E&M before joining Pandora's blockchain team. Kang is the President and CEO of MovieBloc.

Jin earned a bachelor's degree in international/global studies from the University of Washington in Seattle, then went on to Dankook University in South Korea to earn a master's degree in data science. After that, he worked as a research assistant at EY and LEK Consulting before launching Upcoming, an internet services company.

Jin, who is headquartered in South Korea, served as COO of MovieBloc from December 2021 until December 2022. Let's take a look at the current performance of the MBL coin before we look at price expectations for MovieBloc in 2022.

The following is an excerpt from the MovieBloc whitepaper.

According to the MovieBloc whitepaper, content producers who upload their work to the network receive a clear income split, access to viewership statistics, and equitable screening possibilities.

"While the entire market is expanding, the sector is also being dominated by conglomerates with vertical integration throughout three phases: manufacturing, distribution, and display," the study adds. Because the business is primarily focused on getting larger audiences for more profits, this integration creates challenges in the sector, such as biased screen allocation.

"The major victims of this phenomenon are the filmmakers and the viewers." Filmmakers are only allowed to make films that have a strong chance of economic success. The right of customers to access a diverse and free range of content has been taken away."

Recent performance of tokens

The MBL coin declined from $0.004481 on June 26, 2019 to $0.001358 on September 29, 2019, according to CoinMarketCap. It climbed to $0.005198 on February 20, 2020, but then went down to below $0.003 for the rest of the year.

MBL, on the other hand, continued to grow in 2021, reaching a peak of $0.04599 on 2 April 2021 before plummeting to $0.003494 on 22 June 2021. The currency quickly surged to $0.01359 on November 25, 2021, before plummeting to $0.005057 on January 22, 2022.

MBL has subsequently soared to highs of $0.02711 in late March, but has now fallen to $0.00984 as of writing on April 13, 2022.

According to CoinGecko, the coin has lost 4% in the last 30 days as of today. MBL, on the other hand, has risen almost 5% in the last 24 hours. Is the token due for a comeback?

The RSI is signalling a likely trend reversal, according to a panel of technical indicators supplied by DigitalCoinPrice. The short- and long-term SMAs and EMAs, on the other hand, are flashing sell. 14 of the 26 technical indicators point to a sell signal, seven to a hold signal, and five to a buy signal.

The coin has a maximum supply of 30 billion tokens and a circulating supply of 13.53 billion MBL tokens, according to CoinMarketCap, with a market worth of slightly over $134 million.

Now let's have a look at some MovieBloc coin price forecasts.

Expert comment on the pricing of MovieBloc

Predictions should be seen as possibilities rather than hard and fast facts. This is especially true when looking at long-term projections, which might be entirely off the mark due to the cryptocurrency market's intrinsic volatility.

Gov.capital, based on three forecasts' MovieBloc crypto price projections, is bullish, predicting that MovieBloc might reach $0.029 in a year. The MovieBloc pricing projection for 2027 on the platform is $0.151. According to DigitalCoinPrice, the currency might hit $0.0135 as early as April, signifying an almost 40% return. For April 2023, the MBL price forecast is $0.0154. The MovieBloc pricing projection for 2025 is $0.0216, after a regular year-over-year climb to an average of $0.0516 in 2030, according to the website.

Meanwhile, PricePrediction.net predicts that MovieBloc will rise to $0.025 in 2023 before climbing to $0.038 in 2024. The MovieBloc pricing projection for 2030 is $0.33, according to the site.

COTI's indicators are turning optimistic ahead of the introduction of its mainnet and Djed stablecoin.

COTI is turning positive as the Cardano ecosystem becomes more integrated, and the imminent introduction of MultiDAG 2.0 and the Djed stablecoin indicate improving fundamentals. In the fast-paced and competitive crypto market, development never stops, and COTI is one project that is showing some promising signals.

COTI, an enterprise-grade financial technology platform focusing on decentralized payments and digitalization for any type of money, might be on the cusp of a breakthrough, according to VORTECSTM.

After hitting a high of 89 on April 13, the indicator began to identify a positive outlook for COTI.

Expectations for the imminent introduction of MultiDAG 2.0, tighter integration with many aspects of the Cardano ecosystem, and increased use of the protocol's Djed stablecoin are three reasons for COTI's positive outlook.

MultiDAG 2.0 will be released soon.

The protocol's intention to introduce its MultiDAG 2.0 layer, which will enable the issuance of additional tokens on top of the network's Trustchain, is one of the most significant impending advancements for Coti.

With the launch of MultiDAG 2.0 on the COTI mainnet, COTI's treasury will be able to create a governance token, which will be the first enterprise token and payment token built on top of the COTI Trustchain.

In April, the team expects to release a FoxNet for MultiDAG 2.0, followed by a Testnet by the end of May. COTI intends to create a new token standard after the Testnet is published, with a preliminary objective of launching MultiDAG 2.0 on Mainnet in Q3.

Integration of the Cardano ecosystem

COTI's growing connection with the Cardano ecosystem, which has begun to witness the release of its first decentralized apps (DApps) and DeFi protocols, is a second element that has helped it gain traction. The Cardano DeFi Alliance, Adaswap, Project Catalyst, and NFT-Maker are some of the Cardano-based protocols with which COTI has developed working connections.

Adoption of the Djed stablecoin

The introduction of COTI's Djed stablecoin is another positive move. Stablecoin issuance has been a popular strategy in the cryptocurrency industry, since it encourages investors to put more money into the ecosystem in exchange for a higher return.

Djed is a crypto-backed algorithmic stablecoin developed by Cardano and COTI to run the Cardano DeFi ecosystem. It leverages smart contracts to maintain a stable price. COTI expects to release Djed on its Mainnet by the end of Q2 once the project has been completely tested on Testnet and has passed an external security audit.

In the Cardano ecosystem, more than 15 strategic collaborations have been inked with DeFi and NFT protocols, with more planned. This means that once Djed is completely launched, it will have sufficient liquidity and applicability, and if stablecoin launches from other protocols can be used as a predictor of future performance, COTI may gain from the predicted increase in protocol TVL.