Mainnet Dymension akan segera diluncurkan, menandai diperkenalkannya DYM, aset asli protokol Dymension. DYM memainkan peran penting dalam ekosistem dengan memastikan keamanan, mendorong pertumbuhan, dan mempertahankan Dymension bersama dengan RollApps yang dibangun di atasnya.

Distribusi DYM akan terjadi pada musim Rolldrop yang dimulai dengan

Musim 1: Genesis Rolldrop.

Musim 1: Genesis Rolldrop

Mulai hari ini, alamat yang memenuhi syarat dapat mengklaim airdrop mereka dengan mengunjungi:

Peluang ini tersedia hingga 21 Januari 2024 pukul 12:00 UTC, setelah itu saldo yang belum diklaim akan dialokasikan kembali (jumlah diklaim yang ditampilkan adalah jumlah minimum). 100% token yang dialokasikan akan segera dapat diakses di blok genesis mainnet Dymension.

Genesis Rolldrop mewakili awal musim Rolldrop yang akan memberikan insentif kepada pengguna dan pembangun ekosistem. Alokasi signifikan sebesar 70.000.000 DYM (setara dengan 7% dari total pasokan) akan didistribusikan sebagai bagian dari Genesis Rolldrop.

Peluncuran awal Dymension memberikan penghormatan kepada tiga pilar inti kripto: Budaya, Uang, dan Teknologi

Teknologi

Celestia

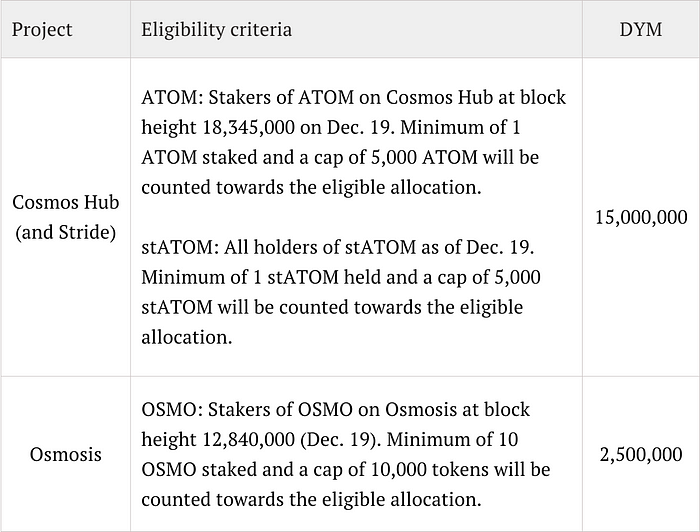

Celestia telah memainkan peran penting dalam lahirnya ekosistem modular. Pengguna yang mempertaruhkan TIA di Celestia pada 19 Desember 2023, pada ketinggian blok 360.000, memenuhi syarat untuk 20.000.000 DYM (2% dari total pasokan). Kelayakan untuk alokasi ini memerlukan taruhan minimal 1 TIA dan batas 5.000 TIA akan dihitung dalam alokasi.

Ethereum L2

Arbitrum dan Optimisme telah menjadi pemain kunci dalam memajukan teknologi rollup. Untuk mendorong penggunanya, serta pengguna Base dan Blast, untuk menjelajahi Dymension, alokasi 10.000.000 DYM (1% dari total pasokan) disediakan. Alokasi ini berfungsi sebagai bentuk apresiasi sekaligus undangan untuk merasakan platform rollup yang terstandarisasi dan terintegrasi secara asli, dengan satu jembatan dan tanpa multi-tanda tangan. Kelayakan untuk alokasi ini didasarkan pada aktivitas pengguna pada rollup, dana dalam kontrak jembatan multi-sig, dan daftar airdrop sebelumnya.

Kosmos

Cosmos adalah pionir dalam tesis rantai aplikasi dan banyak kontribusi penting bagi Dymension berasal dari ekosistem Cosmos. Alamat berikut berhak menerima sebagian dari 17.500.000 DYM (1,75% dari total pasokan) yang dialokasikan ke Cosmos dari pasokan genesis:

Solana

Pertemuan modular terintegrasi dengan alokasi ini.

Keberhasilan Solana dalam membangun komunitas berdedikasi dan pengalaman pengguna yang luar biasa telah membentuk visi produk dan masa depan Dymension. Oleh karena itu, kami telah menyusun daftar lebih dari 180.000 alamat dari berbagai protokol, termasukLubang Cacing, Tensor, dan Drip.Haus, untuk penyaluran 10.000.000 DYM (1% dari total pasokan). Agar memenuhi syarat untuk alokasi ini, alamat harus memiliki saldo minimum 1 SOL pada tanggal 19 Desember.

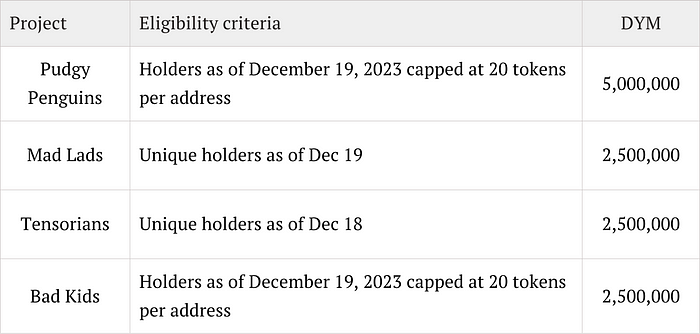

Budaya

Crypto pada dasarnya adalah tentang manusia. Kami mengakui peran mendasar budaya dalam ruang kripto dan mengakui beberapa komunitas yang paling luar biasa. Kami menyambut komunitas ini untuk bergabung dengan Dymension dan mengalokasikan total 12,500,000 DYM (1,25% dari total pasokan) genesis ke koleksi NFT berikut:

Uang

Mengikuti permulaannya, program insentif yang didedikasikan untuk membangun lapisan likuiditas Dymension akan diusulkan ke tata kelola on-chain. Proposal ini bertujuan untuk mengalokasikan 2,500,000 DYM kepada pengguna yang menjembatani token ke jaringan Dymension.

Untuk pengalaman menjembatani yang mudah, tim inti Dymension menyediakan aplikasi web di https://portal.dymension.xyz/

Bagaimana program ini akan berjalan? Itu mudah. Saat Anda menjembatani token yang masuk daftar putih, Anda memiliki opsi untuk mengunci token (segera dapat dibuka kuncinya kapan saja). Protokol Dymension memberi penghargaan kepada pengguna yang mengunci token yang dijembatani dengan hadiah DYM. Hadiah DYM ini dikirimkan langsung ke akun Anda. Token berikut akan memenuhi syarat untuk mendapatkan insentif:

Selain itu, Anda akan memiliki opsi untuk menyetor DYM dan token penghubung Anda ke dalam kumpulan likuiditas berinsentif di Dymension Hub AMM.

Komunitas akan diberitahu kapan program ini dijadwalkan dimulai, yang diperkirakan seminggu setelah peluncuran mainnet.

Ayo bangun ini!

Dokumen ekonomi dan peta jalan yang menjelaskan secara rinci tentang utilitas dan fungsionalitas DYM akan dirilis dalam beberapa minggu mendatang. Nantikan informasi tentang partisipasi dalam musim Rolldrops mendatang dan program insentif.

Periksa kelayakan alamat genesis Anda di sini: genesis.dymension.xyz

Biarkan musim Rolldrop dimulai!